Balance Sheet Test Example

Along with a cash flow test it provides a clear picture of the companys financial status and helps directors to avoid accusations of insolvent trading. As for assets direct market values of assets are rarely if ever available closed-end funds may be an exception but these are hardly run-of-the-mill businesses.

Determining The Short Term Solvency Of A Business Dummies

There are three types of ratios derived from the balance sheet.

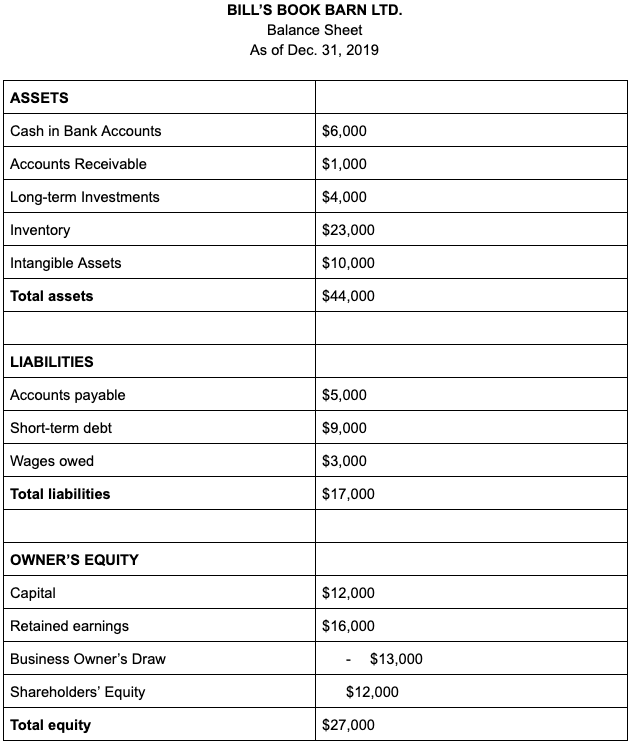

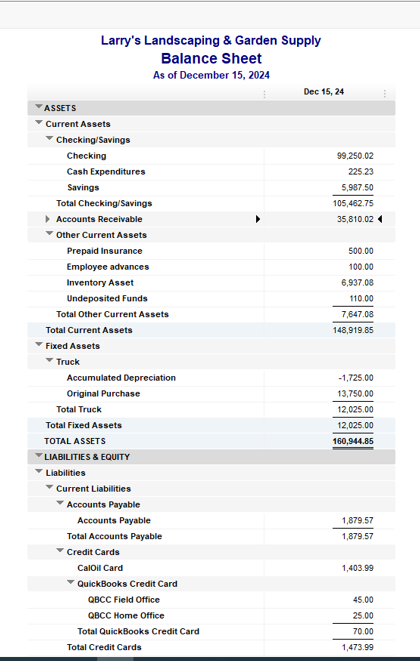

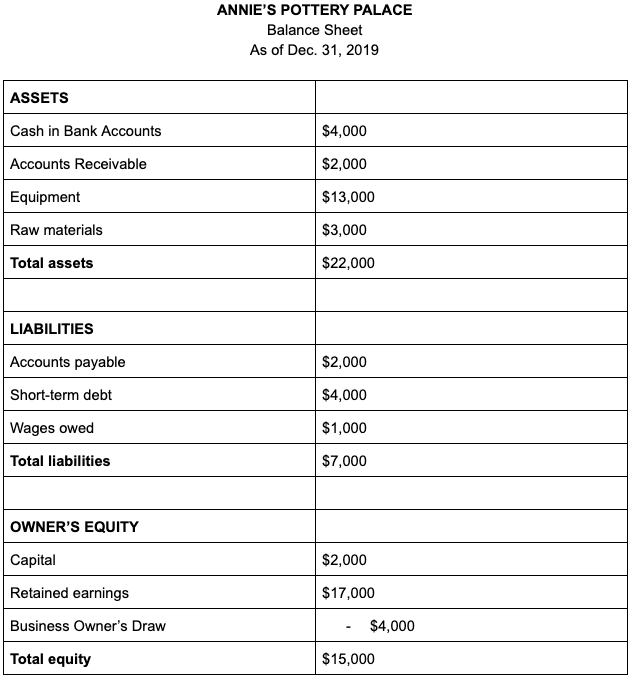

Balance sheet test example. To demonstrate this we have set out below an example of a balance sheet that whilst showing the company to have positive shareholders funds on. Also the balance sheet is often abbreviated as BS or BS. In the account form shown above its presentation mirrors the accounting equation.

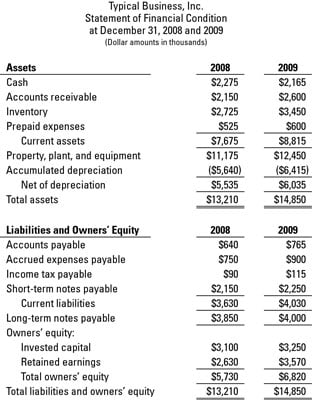

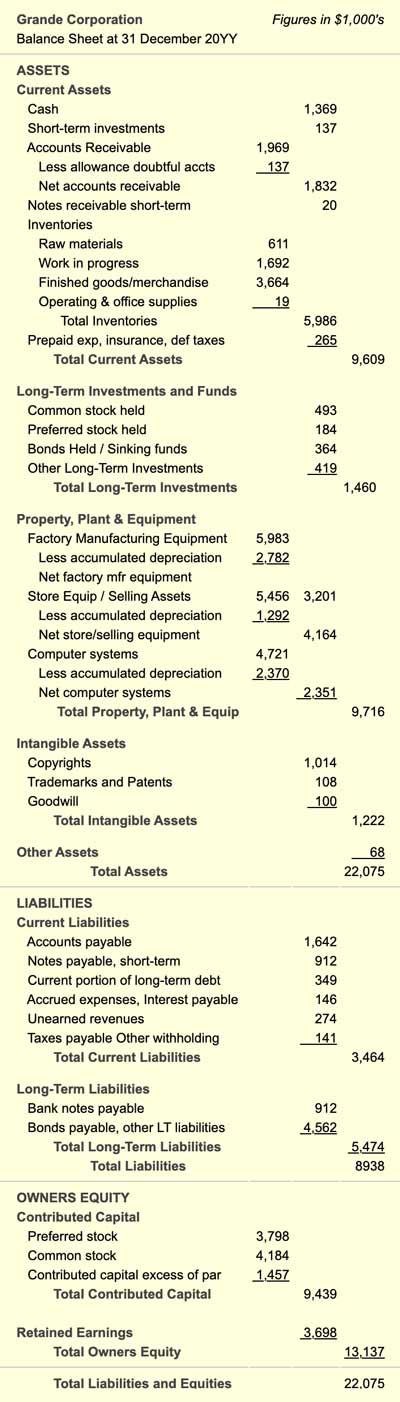

The balance sheet used to sometimes be shown in a horizontal format instead of the vertical format shown above. A balance sheet test is a legal exercise to establish whether your company is in an insolvent state. The following items can all be found on a companys balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements.

SYMBOL SHEET TEST BALANCE INSTRUMENTATION. The balance sheet is also referred to as the statement of financial position or the statement of financial condition. This horizontal format basically looked like one giant T-account for the whole business with Assets on one side and Liabilities and Owners Equity on the other.

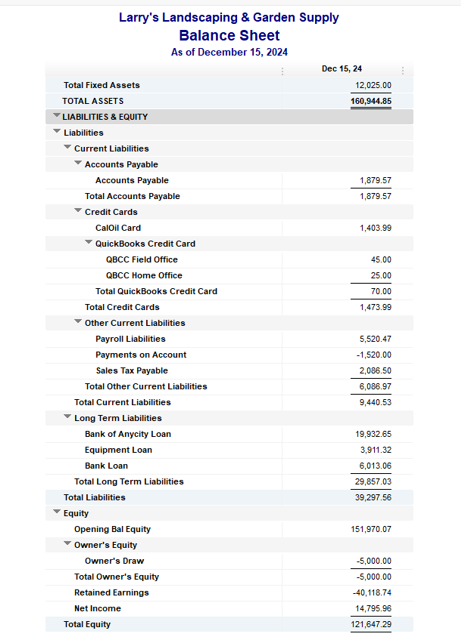

Balance sheet insolvency occurs when a companys total liabilities are greater than its assets a situation that can be determined by taking a balance sheet test. A court will determine what value to attribute to the prospective and contingent liabilities of a company. Liquidity solvency and profitability.

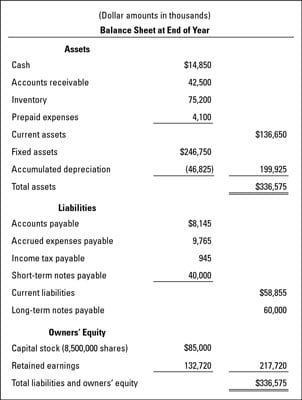

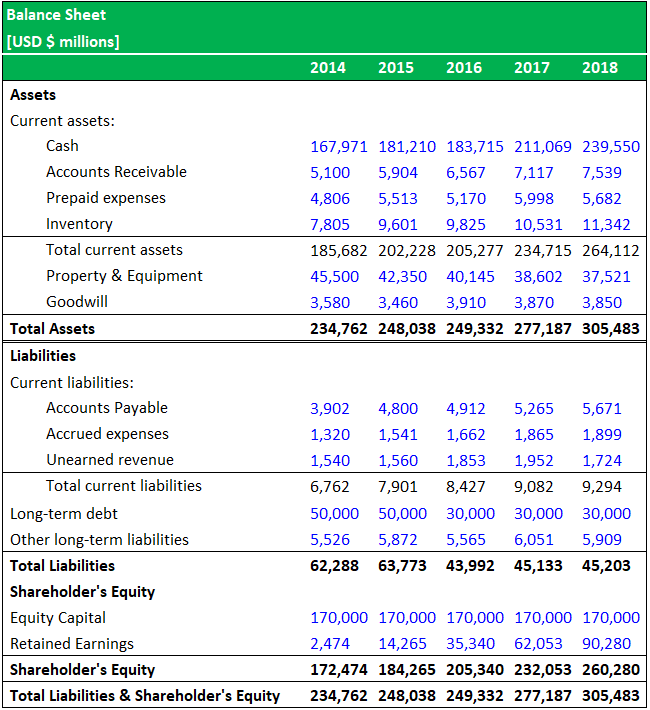

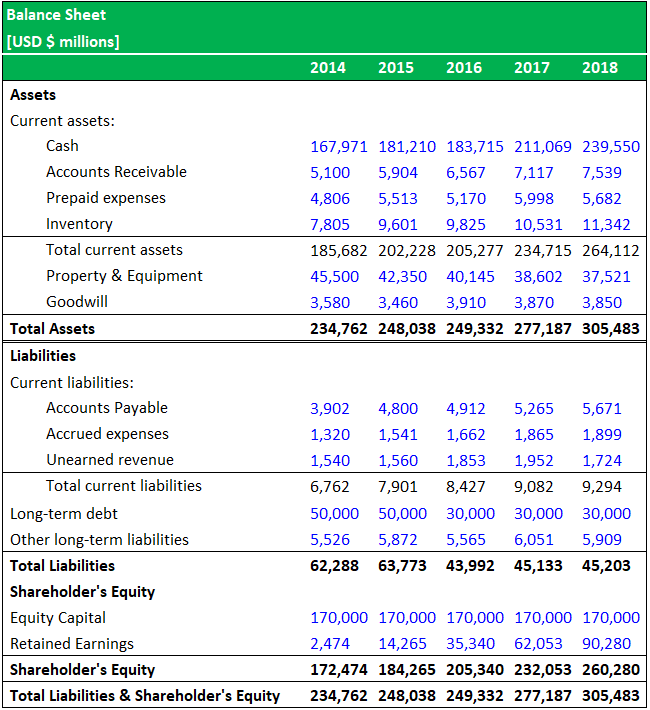

Mario Turpin RSAnalysis Inc. The process of ascertaining from a companys balance sheet what would be available to members of the company were it to be immediately wound up with the assets being sold and the liabilities discharged. We will present examples of three balance sheet formats containing the same hypothetical amounts.

Mechanically the balance-sheet solvency test asks if the market value of assets exceeds the face value of debt. The balance sheet adheres to the following formula. San Francisco 94-01-34.

These three balance sheet segments give investors an idea as to what the company owns and owes as well as the amount invested by shareholders. Profitability ratios show the ability to generate income. Balance sheet ratios evaluate a companys financial performance.

Understand Balance Sheet items like Cash Accounts Receivable and Deferred Revenue. Once you understand why what goes where. To do this you need to incorporate all the transaction and financing-related adjustments needed to produce the Pro Forma Balance Sheet.

1 All corrections for instruments used for testing and balancing are traceable back to the national bureau of standards and. While the balance sheet can be prepared at any time it is mostly prepared at the end of. This includes deferred payments or potential litigation decisions against a company so a precise arrangement can be made.

As a next step build out the Pro Forma Balance Sheet using the given 2011 balance sheet. Liquidity ratios show the ability to turn assets into cash quickly. Balance sheet also known as the statement of financial position is a financial statement that shows the assets liabilities and owners equity of a business at a particular dateThe main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

A balance sheet contains specific information about the net worth assets and liabilities of a business. Balance sheet is a financial statement that summarizes a companys assets liabilities and shareholders equity at a specific point in time. Michael Sanden RSAnalysis Inc.

The definition of insolvency is the inability to discharge your liabilities as and when they fall due. What is balance sheet insolvency. Solvency ratios show the ability to pay off debts.

The formula for calculating the ratio is as follows. The Acid-Test Ratio Formula. The balance sheet examp.

If on examination the company is found to be insolvent ie. Example of a balance sheet using the account form. It is essential for this tool to be precise as financial records are taken seriously by investors and other stakeholders of the business no matter what industry the company belongs to.

Pro Forma Balance Sheet. The balance sheet heading will specify a. The balance sheet reflects an instant or a POINT in time.

If youre seeing this message it means were having trouble loading external resources on our website. The notes to the financial statements are omitted as they will be identical regardless of the format used. Analytical valuation toolsincluding discounted cash flow analysis.

Liabilities exceed its assets it is an offence for the.

How To Read A Business Balance Sheet Dummies

Lbo Modeling Test Example Street Of Walls

Lbo Modeling Test Example Street Of Walls

Lbo Modeling Test Example Street Of Walls

Financial Statement Basics For Artists Balance Sheet Art Marketing And Business By Neil Mckenzie Creatives And Business Llc

How To Record Balance Sheet Transactions Examples Getmoneyrich

How To Read A Balance Sheet Bench Accounting

Balance Sheet Formula Assets Liabilities Equity

How To Calculate The Quick Ratio Examples The Blueprint

Balance Sheet Example Format Vertical

Balance Sheet Example Format Vertical

How Balance Sheet Structure Content Reveal Financial Position

Free Balance Sheet Template Excel Google Sheets Brixx

Balance Sheet Definition Examples Assets Liabilities Equity

How To Calculate The Quick Ratio Examples The Blueprint

How To Read A Balance Sheet Bench Accounting

Post a Comment for "Balance Sheet Test Example"