Example Of A Ministers W2 Form

If the church does not do so it should report this amount. Compensation paid to a minister or clergy member typically is reported to them on Form W-2 if the minister is an employee of the church or Form 1099-MISC if the minister performed services such as weddings and baptisms.

006 Id Card Template Word Ideas 1920x1920 Employee Microsoft In Employee Card Template Word Professional Templa Employees Card Id Card Template Card Template

There are other kinds of income that would generally be considered as income except for the fact that they have been excluded within the income tax code or regulations.

Example of a ministers w2 form. Lastly the housing allowance should be reported in Box 14 of Form W-2. Federal taxes withheld from paycheck. Do I just not check any box then.

The church pays her an annual salary of 60000 of which 7500 is designated for utility costs. Joan Carlton is a full-time minister. Following the notes is a sample W-2 Form for a Minister.

Clergy W-2 wages not subject to Medicare. QSEHRA and HRA health reimbursements plans. Group health insurance premiums.

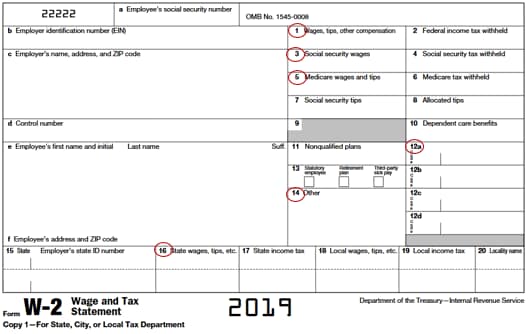

Forms W-2 Church and College Form 1040 Schedule 1 Schedule 2 Schedule A Schedule C Schedule SE QBI Deduction Form 8995 tax return attachments Example Two. Example of Form W-2 for Clergy This is an example of how to fill out a Form W-2 for Rev. This sample spreadsheet and W-2 are just that samples.

DO include decimal point and cents even if 0. 2018 W-2s are due to all employees by January 31 2019. The church allows her to use a parsonage that has an annual fair rental value of 24000.

This box should be empty on a clergy W-2. If you have further questions give us a call at 877-494-4655. Unique W-2 Issues that are more relevant for churches and ministers are highlighted in the notes below.

Code C-If the pastor is provided more than 50000 in CPP and BPP death benefits or group term life insurance you need to show the premiums attributed to benefits in excess of 50000. The Pastors income should be reported in box 1 and any Federal income tax withheld should be reported in box 2. This box should be empty on a clergy W-2.

Members of the Clergy. The Pastor should ALWAYS receive a W-2 form from the church each year. Example of Pastors W-2.

Sue Service serves as pastor of a local United Methodist church. Smith is provided a parsonage and the church pays a 1500 housing parsonageutility allowance to his pursuant to an estimate of such expenses and a properly adopted. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld.

Boxes 3-6 should be blank since Pastors SHOULD NOT have Social Security or Medicare taxes withheld. Alabama if a pastor opts out of FICA what does the church check on kind of filer on the W3. At year-end as an amount that shemust include in Social Security income along with the fair rental value of the parsonage.

Pastor Smith has a base salary of 25000. On a W-2 form do NOT include a sign or commas. Smith has a salary of 25000 from the local church.

Assume that Pastor J qualifies as a minister for federal tax. Pastor J is an ordained minister employed by a church. W3 reporting form for Pastors W2.

Clergy default to 0 unless optional withholding is set up with the church. Housing Parsonage Manse allowance. Medicare is not withheld.

She received a cash salary of 40000 from her church. Most ministers are treated as dual-status taxpayers. Please note that this example of how to report a ministers income on Form W-2 is very general may vary depending on your specific situation.

Doe also receives a non-accountable annual travel allowance of 3000. A minister and with respect to compensation received in the exercise of ministerial services-Example. In addition he works a second job for a secular employer.

During the preceding year Rev. Example of Form W-2 for Clergy Example of Form W-2 for Clergy Rev. Service lived in a church parsonage furnished by her church and.

On Form W-2 but it may be reported in. His base salary does not include his housing allowance He is also received 9000 for his housing allowance in addition to his salary. 417 Earnings for Clergy.

A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or organization that employs him or her to provide ministerial services. Your pastors tax situation may be different andor unique. 1000 would be reported on the W-2.

The church doesnt file a 941 or 944 report because there is nothing to report. They must pay social security and Medicare by filing Form 1040 Schedule SE Self-Employment Tax. His housing allowance was properly set up with an adopted resolution before it was paid.

Clergy W-2 wages not subject to Social Security. The IRS Form W-2 instructions for a complete list of codes The following codes are the most relevant for clergy. Service has a salary of 25000 from the local.

For additional information refer to Publication 517 Social Security and. Some examples of these are. However there are some exceptions such as traveling evangelists who are independent contractors self-employed under.

Information to help with preparing IRS Form W-2 for clergy which can be complicated can be found on the Conference websiteUse the worksheet and example here as a guide for preparing your pastors W-2. The IRS has a publication that should be used with general instructions for completing a W-2 form.

Reports And Info About W 2 And W 3 Forms

Sample Teacher Evaluation Form Example Teacher Evaluation Evaluation Form Teaching Process

W3 Form Box 3 The Reason Why Everyone Love W3 Form Box 3 In 2021 Irs Forms Power Of Attorney Form Tax Forms

What Is Form 4361 What Is It Used For The Pastor S Wallet

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Comcast Bill Sample Bill Template Comcast Play Money

Irs Form 8821 Tax Information Authorization

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Unbelievable Facts Printable Job Applications Reference Letter For Student

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Templates Creating A Newsletter Email Newsletter Template

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Employee Tax Forms Quarterly Taxes

2014 W2 Form Pdf Fillable Awesome Sample W2 Form Templates 2016 Remarkable 2018 Filled Out Example Models Form Ideas

How To Prepare W 2s For Church Employees Including Ministers Church Law Tax

Publication 517 Social Security And Other Information For Members Of The Clergy And Religious Workers Comprehensive Example

Understanding Your Tax Forms Form W 2 Wage And Tax Statement W2 Forms Tax Forms Tax Time

Filing A Form W 2 For A Church

Cms 1500 Example Form Printable Job Applications Templates Rental Agreement Templates

Access Denied Internal Revenue Service Lost Employer Identification Number

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Irs Forms Employee Tax Forms

Post a Comment for "Example Of A Ministers W2 Form"